If you want a do-it-yourself way of filing for your taxes with the BIR then this video is for you. In this episode of our taxation for freelancers series I'm. Paket add DllExport -version 1.7.4. The NuGet Team does not provide support for this client. Please contact its maintainers for support. #r 'nuget: DllExport, 1.7.4'. #r directive can be used in F# Interactive, C# scripting and.NET Interactive. Copy this into the interactive tool or source code of the script to reference the package.

Intel® XTU Component Device 7.4.1.3 Watchdog Device Driver 11.7.0.1002 Known Issue(s):. HWBOT Compare Online feature misidentifies 10850K’s as engineering samples A portion of this software is object code provided with the Microsoft Enterprise Library. This object code is provided with the license noted below. Supported Platforms: 1. Maria eBIRForms Package 7.6.1, Hi, were you able to solve this problem? I am currently experiencing the same, I also received confirmation but then when I opened my previous 2551q, all blanks were filled with 'undefined.' Please let me know, thank you.

Ebir forms version 7.4 keyword after analyzing the system lists the list of keywords related and the list of websites with related content, in addition you can see which keywords most interested customers on the this website

Keyword Suggestions

Most Searched Keywords

Domains Actived Recently

› At-wellness.net

› Ccswrm.kku.ac.th

› Dvidshub.net

› Marcorengasn.org

› My-yo.ru

› Ngoknumeqefy.mihanblog.com

› Retetescu.ro

› Same.org

› Suaongchuauc.vn

Websites Listing

We found at least 10 Websites Listing below when search with ebir forms version 7.4 on Search Engine

› Ebirforms bir gov ph

› Offline ebirforms download

To download offline ebirforms package v7.4.1' Keyword

Keyword-suggest-tool.comDA: 28PA: 50MOZ Rank: 78

- Ebir forms version 7.4' Keyword Found Websites Listing

- Keyword-suggest-tool.com DA: 28 PA: 31 MOZ Rank: 76

- To download offline ebirforms package v7.4.1' Keyword ; Keyword-suggest-tool.com DA: 28 PA: 50 MOZ Rank: 81

PHILIPPINE TAX TALK THIS DAY AND BEYOND: eBIRForms …

Philippinetaxtalk.blogspot.comDA: 30PA: 50MOZ Rank: 81

- New Offline eBIRForms Package v7.9.1 is now Available for Download - 5/25/2021

- BIR Issued a Circular of Filing of Returns as Well as Payment of Taxes Due Thereon Falling Within the Period March 22, 2021 to April 30, 2021 - 4/3/2021

- Availability of the Offline Bureau of Internal Revenue Forms (eBIRForms) Package Version 7.8 - 3/5/2021.

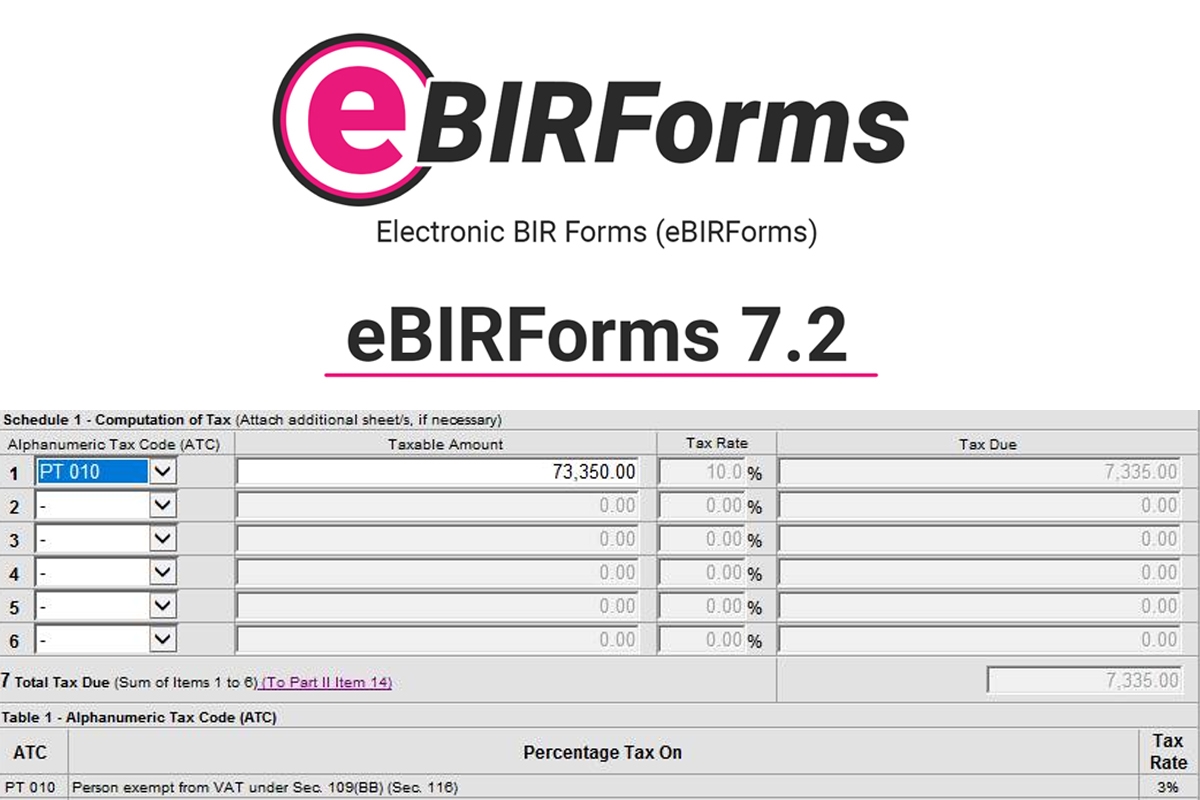

Just In: BIR Releases eBIRForms Package Version 7.2

Juan.taxDA: 8PA: 50MOZ Rank: 60

- Just In: BIR Releases eBIRForms Package Version 7.2

- Update as of November 7, 2018 — The eBIRForms Package was reverted back to version 7.1, but returned to v7.2 at 10:35 a.m this morning

- After the release of eBIRForms Package version 7.1 last May of this year, the Bureau of Internal Revenue had released yet another version of the application.

EBIRForms (free) download Windows version

En.freedownloadmanager.orgDA: 26PA: 31MOZ Rank: 60

- Online submission of the filled forms is possible

- Download eBIRForms 7.9.1 from our website for free

- The most popular versions of the software are 7.6, 6.3 and 6.1

- The program lies within Business Tools, more precisely Finances

- This free program is a product of Information Systems Group of the Bureau of Internal Revenue.

EBIRForms Package version 7.6 now available

Pressreader.comDA: 19PA: 50MOZ Rank: 73

- As announced in Revenue Memorandum Circular 16-2020, taxpayers can now download eBIRForms Package Version 7.6 from the BIR website

- The latest version includes the following tax returns: Field validation and automated computation for BIR Form 1701 (Annual Income Tax Return for Individuals Including Mixed Income Earners, Estates, and Trusts

EBIRforms Latest Version Business Software with BIR Forms

Qne.com.phDA: 14PA: 26MOZ Rank: 45

- EBIRForms or Electronic Bureau of Internal Revenue Forms is available for all taxpayers as a tool for preparing and filing tax returns

- EBIRForms is expected to improve data management from both taxpayers and BIR

- Taxpayers may download the eBIRForms Software Package (Offline Package) and they will be able to fill up tax returns then submit the

BIR Releases eBIRForms Package 7.1

Juan.taxDA: 8PA: 41MOZ Rank: 55

- May 9, 2018 — Wednesday — Weeks after the arrival of eBIRForms Package version 7, the Bureau of Internal Revenue released version 7.1 of their application today

- About EBIRForms Package 7.1 The updated version of the eBIRForms package was released to introduce new forms such as 0619-E and 0619-F, as mentioned in Revenue Regulations No

Download offline ebirforms for windows 10 for free

En.freedownloadmanager.orgDA: 26PA: 50MOZ Rank: 83

- Download offline ebirforms for windows 10 for free

- Business software downloads - eBIRForms by Information Systems Group of the Bureau of Internal Revenue

- And many more programs are available for instant and free download.

EBir Form Program Installation Guide

Youtube.comDA: 15PA: 6MOZ Rank: 29

Step by Step Program Installation for the updated Version 7.1Download Page https://www.bir.gov.ph/index.php/eservices/ebirforms.html Direct Download : http:/

How to download ebirforms version 7.1 Archives

Filipiknow.netDA: 14PA: 43MOZ Rank: 66

- Tag: how to download ebirforms version 7.1

- Link to How to File and Pay Taxes Using Electronic BIR Forms (eBIRForms) How to File and Pay Taxes Using Electronic BIR Forms (eBIRForms) The eBIRForms is a system that enables non-eFPS taxpayers in the Philippines to prepare and file their tax returns conveniently and accurately.

EBIRForms Package v7.6 now available Grant Thornton

Grantthornton.com.phDA: 24PA: 50MOZ Rank: 84

- As announced in Revenue Memorandum Circular No

- 16-2020, taxpayers can now download eBIRForms Package Version 7.6 from the BIR website

- The latest version includes the following tax returns: Field validation and automated computation for BIR Form 1701 (Annual Income Tax Return for Individuals Including Mixed Income Earners, Estates, and Trusts

Ebir forms version 7.4' Keyword Found Websites Listing

Keyword-suggest-tool.comDA: 28PA: 31MOZ Rank: 70

- Ebir forms version 7.4' Keyword Found Websites Listing

- Keyword-suggest-tool.com DA: 28 PA: 31 MOZ Rank: 68

- Ebir forms version 7.4 keyword after analyzing the system lists the list of keywords related and the list of websites with related content, in addition you can see which keywords most interested customers on ….

Availability of offline eBIR Forms Package Version 7.2

Grantthornton.com.phDA: 24PA: 50MOZ Rank: 86

- Availability of offline eBIR Forms Package Version 7.2

- THE Bureau of Internal Revenue (BIR) released Revenue Memorandum Circular 93-2018 last Oct

- 31 announcing the availability of the offline electronic BIR Forms (eBIRForms) Package Version 7.2

- The latest version is now accessible through www.bir.gov.ph and www.knowyourtaxes.ph.

EBIRForms Package v6.3 (New Version)

Philippinetaxtalk.blogspot.comDA: 30PA: 47MOZ Rank: 90

- The bureau has issued a new version of eBIRForms Package v6.3 to update the BIRForms Package v6.2 for taxpayers who will be filing their income tax returns and other tax declarations and returns for the Year 2016 and Year 2017

- I have read in the Job Aid for the use of Offline eBIR Forms Package about the page setup to print the forms and the page setup to print the forms …

How to download BIR software for tax filing online My

Myfinancialcoach.phDA: 19PA: 50MOZ Rank: 83

Tax Filing Made Easy: Download eBIRForms Software now! The Electronic Bureau of Internal Revenue Forms (eBIRForms) was developed primarily to provide taxpayers with an alternative mode of preparing and filing tax returns that is easier and more convenient.

Newly revised BIR Form No. 1701Q Facing PH Taxes

Phtaxes.wordpress.comDA: 21PA: 44MOZ Rank: 80

- The newly revised BIR Form No. 1701Q is not yet available for eFPS filers

- As a work-around, eFPS filers shall use the newly revised return in the Offline eBIRForms Package v7.1 to file the quarterly income tax return for the first quarter of 2018

- In case an eFPS filer paid the income tax due for the first quarter using the old return, the

How-to-File-1701A-and-Use-the-Alphalist

Coursehero.comDA: 18PA: 50MOZ Rank: 84

- Step 2: Install eBIR Forms Version 7.4.1 to your computer

- Step 4: You will be directed to your Profile

- Enter your TIN and your RDO code and the rest of your background info will auto-populate

- Step 5: At the dropdown menu of List of BIR Forms, find 1701A and click “Fill-up” *Btw, I don’t mean to be a Grammar Nazi but I always teach “fill out” or

Download RoboForm 7.7.9.9 for Windows

Oldversion.comDA: 18PA: 25MOZ Rank: 60

- When you upload software to oldversion.com you get rewarded by points

- For every field that is filled out correctly, points will be rewarded, some fields are optional but the more you provide the more you will get rewarded!

Offline e-birforms package is not opening help (Para sa

Reddit.comDA: 14PA: 50MOZ Rank: 82

- Baka po may naka fix na ng problem? eBIR form 7.4 po version

- Sometimes when you fall, you fly~ You can ask them directly

- They would definitely know their files best and they have probably encountered similar problems from other users before.

File and Pay Your Taxes Online through the eBIR Forms

Handsonparentwhileearning.comDA: 33PA: 50MOZ Rank: 31

- Now, let me tell you why I like using these forms

- Using the forms lessened my questions and confusion compared to manual filing because some of the fields that are not applicable to me are already off-limits to me

- The system and the forms are designed in such a way that I only fill up the fields that I need to

Offline eBIRForms Package v7.6.1 Archives

Newstogov.comDA: 13PA: 38MOZ Rank: 71

- eBIR forms: How to file tax returns using eBIR forms? Leave a Comment / Guides / By admin

- The Electronic Bureau of Internal Revenue Forms (eBIRForms) allows taxpayers with an alternative method of preparing and filing tax returns that are easier and more convenient

- The use of eBIRForms by taxpayers will improve the BIR’s tax return data

Can't open eBIRForms6.2 in Windows 10 64bit.

Answers.informer.comDA: 20PA: 50MOZ Rank: 91

- Ebirform offline 7.4.2 cannot run in windows 10 64 bit, how to troubleshoot on this? thanks for the future answer! 0 votes

- Answered Apr 20, 2020 by Docrj How to get a soft copy of BIR form 1601-EQ? im using version 7.7 im experiencing this error, 'PLease use the newer version if you wish to file for 2018 and up' Quick answers.

Annual Income Tax Return 1701A Individuals Earning Income

Home.kpmgDA: 9PA: 50MOZ Rank: 81

- 1701A January 2018 Page 1 Annual Income Tax Return Individuals Earning Income PURELY from Business/Profession [Those under the graduated income tax rates with OSD as mode of deduction OR those who opted to avail of the 8% flat income tax rate] Enter all required information in CAPITAL LETTERS using BLACK ink.

EBIRForms version 6.1 now available

Philcpa.orgDA: 11PA: 46MOZ Rank: 80

- This happens despite of the several tries to submit the forms

- Some netizen found relief by downgrading their current installation to version 5.0, since other newer and older version are not working as well

- So in a short period of time, some taxpayers, but not all, were able to file their returns using eBIRForms v6.0.

How can I Generate and View the BIR Alphalist

Support.salarium.comDA: 20PA: 50MOZ Rank: 94

- The BIR Alphabetical List, or alphalist is an attachment to BIR form 1604-CF, and includes an alphabetical list of employees who have paid tax in line with Philippine Revenue Regulations.

- The alphalist contains your employees’ names, Tax Identification Numbers (TINs), gross compensatio n paid by present and previous employers for the calendar year, taxes deducted from their salaries, and

Excel Format to DAT File BIR-EXCEL-UPLOADER

Bir-excel-uploader.comDA: 22PA: 30MOZ Rank: 77

- Using the BIR Form 2307 Excel Template, please take time to analyze the sample data, address field is optional

- Before you can proceed on printing BIR Form 2307, you need to set a basic printing option

- Generate Multiple BIR Form 2307

- Select BIR Form 2307 Template: Print BIR FORM 2307 **Please ensure that popup blocker or Adblocker is disabled

Use Only Item Annual Income Tax Return 1701

Pwc.comDA: 11PA: 42MOZ Rank: 79

- Annual Income Tax Return Page 5 - Schedules 1 to 4A BIR Form No

- 1701 June 2013 (ENCS) 170106/13ENCSP5 TIN Tax Filer’s Last Name 0 0 0 0 SCHEDULES-REGULAR RATE Schedule 1 - Gross Compensation Income and Tax Withheld (Attach additional sheet/s, if necessary) Gross Compensation Income and Tax Withheld (On Items 1, 2 & 3, enter the required information for each of …

#AskTheTaxWhiz: Should I use BIR Form No. 1701 or 1701A

Rappler.comDA: 15PA: 46MOZ Rank: 88

- 1701, you have to go to the BIR

- According to Revenue Memorandum Circular No

- 37-2019, the new form is not yet available via eBIRForms or eFPS.

› Bible quotes for new year

› Bcc corporate my web...

› Puthiya thalaimurai tv live streaming

› Iron horse atv

› Multiple systems atrophy 2016 stories

› Ebir forms version 7.4

TopElectronic BIR Forms (eBIRForms)

Overview

The Electronic Bureau of Internal Revenue Forms (eBIRForms) was developed primarily to provide taxpayers with an alternative mode of preparing and filing tax returns that is easier and more convenient. The use of eBIRForms by taxpayers will improve the BIR's tax return data capture and storage thereby enhancing efficiency and accuracy in the filing of tax returns. Through the use of the downloadable eBIRForms Software Package (also known as the Offline Package), taxpayers and Accredited Tax Agents (ATAs) will be able to fill up tax returns offline and submit it to the BIR through the Online eBIRForms System.

Offline eBIRForms Package | Online eBIRForms System |

Coverage

The eBIRForms is a package application covering thirty-six (36) BIR Forms comprised of Income Tax Returns; Excise Tax Forms; VAT Forms; Withholding Tax Forms; Documentary Stamp Tax Forms; Percentage Tax Forms; ONETT Forms and Payment Form, the list of which is shown below.

Ebirforms 7.4.1

|

|

| |

1 | 0605 | July 1999 (ENCS) | Payment Form |

2 | 1600 | September 2005 (ENCS) | Monthly Remittance Return of Value-Added Tax and Other Percentage Taxes Withheld |

3 | 1600WP | January 2010 (ENCS) | Remittance Return of Value-Added Tax and Other Percentage Taxes Withheld by Race Track Operators |

4 | 1601-C | July 2008 (ENCS) | Monthly Remittance Return of Income Taxes Withheld on Compensation |

5 | 1601-E | August 2008 (ENCS) | Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded) |

6 | 1601-F | September 2005 (ENCS) | Monthly Remittance Return of Final Income Taxes Withheld |

7 | 1602 | August 2001 (ENCS) | Monthly Remittance Return of Final Income Taxes Withheld on Interest Paid on Deposits and Yield on Deposits Substitutes/Trusts/Etc. |

8 | 1603 | November 2004 (ENCS) | Quarterly Remittance Return of Final Income Taxes Withheld on Fringe Benefits Paid to Employees Other than Rank and File |

9 | 1604-CF | July 2008 (ENCS) | Annual Information Return of Income Taxes Withheld on Compensation and Final Withholding Taxes |

10 | 1604-E | July 1999 (ENCS) | Annual Information Return of Creditable Income Taxes Withheld (Expanded)/Income Payments Exempt from Withholding Tax |

11 | 1606 | July 1999 (ENCS) | Withholding Tax Remittance Return For Onerous Transfer of Real Property Other than Capital Asset (Including Taxable and Exempt) |

12 | 1700 | June 2013 (ENCS) | Annual Income Tax Return For Individuals Earning Purely Compensation Income (Including Non-Business/Non-Profession Income) |

13 | 1701 | June 2013 (ENCS) | Annual Income Tax Return For Self-Employed Individuals, Estates and Trusts |

14 | 1701Q | July 2008 (ENCS) | Quarterly Income Tax Return For Self-Employed Individuals, Estates and Trusts (Including those w/ both Business and Compensation Income) |

15 | 1702-EX | June 2013 (ENCS) | Annual Income Tax Return For Use ONLY by Corporation, Partnership and Other Non-Individual Taxpayer EXEMPT Under the Tax Code, as Amended, [Sec. 30 and those exempted in Sec. 27(C)] and Other Special Laws, with NO Other Taxable Income |

16 | 1702-MX | June 2013 (ENCS) | Annual Income Tax Return For Corporation, Partnership and Other Non-Individual with MIXED Income Subject to Multiple Income Tax Rates or with Income Subject to SPECIAL/PREFERENTIAL RATE |

17 | 1702-RT | June 2013 (ENCS) | Annual Income Tax Return For Corporation, Partnership and Other Non-Individual Taxpayer Subject Only to REGULAR Income Tax Rate |

18 | 1702Q | July 2008 (ENCS) | Quarterly Income Tax Return For Corporations, Partnerships and Other Non-Individual Taxpayers |

19 | 1704 | May 2001 | Improperly Accumulated Earnings Tax Return |

20 | 1706 | July 1999 (ENCS) | Capital Gains Tax Return For Onerous Transfer of Real Property Classified as Capital Asset (both Taxable and Exempt) |

21 | 1707 | July 1999 (ENCS) | Capital Gains Tax Return for Onerous Transfer of Shares of Stock Not Traded Through the Local Stock Exchange |

22 | 1800 | July 1999 (ENCS) | Donor's Tax Return |

23 | 1801 | July 2003 (ENCS) | Estate Tax Return |

24 | 2000 | June 2006 (ENCS) | Documentary Stamp Tax Declaration/ Return |

25 | 2000-OT | June 2006 (ENCS) | Documentary Stamp Tax Declaration/ Return (One-Time Transactions) |

26 | 2200A | April 2014 (ENCS) | Excise Tax Return for Alcohol Products |

27 | 2200AN | August 2003 (ENCS) | Excise Tax Return for Automobiles & Non-Essential Goods |

28 | 2200M | September 2005 (ENCS) | Excise Tax Return for Mineral Products |

29 | 2200P | September 2005 (ENCS) | Excise Tax Return for Petroleum Products |

30 | 2200T | April 2014 (ENCS) | Excise Tax Return for Tobacco Products |

31 | 2550M | February 2007 (ENCS) | Monthly Value-Added Tax Declaration |

32 | 2550Q | February 2007 (ENCS) | Quarterly Value-Added Tax Return |

33 | 2551M | September 2005 (ENCS) | Monthly Percentage Tax Return |

34 | 2551Q | February 2002 (ENCS) | Quarterly Percentage Tax Return |

35 | 2552 | July 1999 (ENCS) | Percentage Tax Return For Transactions Involving Shares of Stock Listed and Traded Through the Local Stock Exchange or Through Initial and/or Secondary Public Offering |

36 | 2553 | July 1999 (ENCS) | Return of Percentage Tax Payable Under Special Laws |